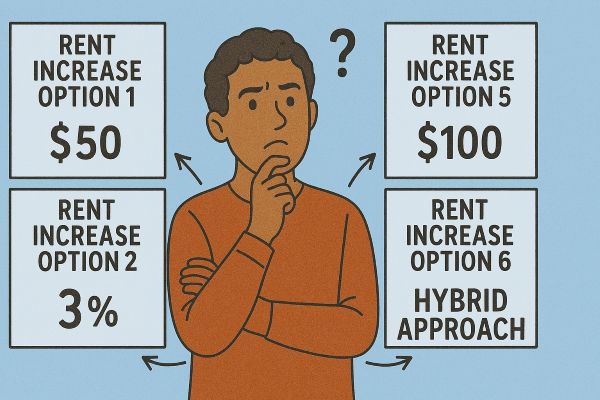

Determining rent during lease renewal is a crucial aspect of property management, and there are several approaches to consider. Setting the right rent ensures profitability while maintaining resident satisfaction and reducing turnover. However, there is no one-size-fits-all strategy, and each approach has advantages and challenges.

Keeping the Rent the Same

One straightforward method is to keep the rent unchanged. This is the easiest option and keeps residents happy, reducing turnover and vacancy risks. Residents who feel they are getting a good deal are more likely to renew their lease, saving on the costs and effort of finding a new renter. Maintaining stable rent can also foster a strong landlord-resident relationship, leading to long-term retention.

However, by keeping rent unchanged, you might miss out if market rents increase. If neighboring properties charge significantly more, you could underpin your unit and leave money on the table. This could also lead to complications if you eventually need to adjust the rent to market rates, as a sudden sharp increase could cause resident dissatisfaction.

Raising the Rent by a Fixed Percentage

Another approach is to raise the rent by a set percentage, such as 1%, 2%, 3%, or even 5%. This method simplifies the process, making it consistent and predictable. You don’t have to analyze the market each time a lease is up for renewal, as the rent increase follows a standard formula. This predictability can also help residents plan their budgets, making rent increases more palatable.

But this approach has its downsides. Raising rent might push residents to look for cheaper alternatives if the market is declining. Conversely, if market rents are rising faster than your set percentage, you could still be underpricing your property and not maximizing potential income. This method is convenient but may not always align with actual market conditions.

Market-Driven Rent Adjustments

A more market-driven strategy involves analyzing current rental trends. If market rents are increasing, you raise the rent accordingly. If they are declining, you adjust to stay competitive. This ensures that your rental price remains fair and attractive compared to similar properties.

While this method is responsive to real-time market conditions, it comes with challenges. What if your rent is already significantly higher than the market? Or what if it's significantly lower? For instance, if your rent is $500 and the market rate is $1,000, you can't simply double the rent in one renewal period without potentially losing the resident. Similarly, if your rent is already above market value, reducing it to the market rent may cause you to miss out on the potential revenue.

Another con of this approach is that it is time-consuming. You must evaluate the market one property at a time, making it lengthy, especially when managing multiple units. This method requires careful research and comparison with similar rentals in the neighborhood, which can be labor-intensive.

Cost-Based Rent Increases

Another way to determine rent is by using a cost analysis of the property. This means looking at maintenance, property taxes, and insurance expenses. For example, if you had an extra expense of $1,200 a year, you might raise the rent by $100 monthly to cover that cost. If property taxes or insurance premiums increase, you can adjust the rent accordingly to cover these expenses.

However, the downside of this approach is that expenses fluctuate. One year, there may be minimal expenses, and the following year, significant unexpected costs could be. This could lead to inconsistent rent increases, which may not be sustainable for residents in the long run. If there is no increase in one year and a significant expense arises in the following year, residents may feel that a sudden, steep rent increase is unfair.

Basing Rent Increases on Resident Performance

One strategy for setting renewal rates is to adjust the rent based on how well a resident follows the lease. Residents who consistently pay on time and follow all terms may receive a lower increase—or no increase at all. Those with late payments or lease violations could face higher renewal rates. This approach can encourage better behavior and reward, responsible residents, potentially reducing turnover and late payments.

However, there are some drawbacks. Tracking each resident’s performance and converting it into a renewal figure is time-consuming. It can also raise fair housing concerns—if one resident’s rent goes up and another’s doesn’t, it may be perceived as unfair or discriminatory. And because this method isn’t based on current market trends, you might end up pricing your rental too high, increasing the vacancy risk if a resident decides not to renew.

The Hybrid Approach

A hybrid approach combines multiple factors to determine the best rent increase strategy. This means considering market trends, typical rent increase amounts, property expenses, and resident behavior before deciding. By analyzing all these elements together, you can ensure that the rent adjustment remains competitive while covering costs and maintaining resident satisfaction.

This method offers flexibility and allows for a more strategic, case-by-case decision rather than a one-size-fits-all approach. For instance, if the market supports an increase, but a long-term resident has always paid on time and taken great care of the property, you might choose a more minor increase to encourage retention. On the other hand, if costs have risen significantly and the resident is paying well below market rent, a more significant increase may be necessary.

The Importance of Communication with Residents

Regardless of the approach taken, communication is key. Residents appreciate transparency, and explaining the reasoning behind a rent increase can help reduce friction. Providing data on market trends, tax increases, or rising maintenance costs can help residents understand the need for adjustments. Giving ample notice and offering incentives, such as minor upgrades or extended lease terms, can also help ease the transition.

Final Thoughts

Ultimately, there is no single best way to determine rent increases. Each method has benefits and drawbacks, and the right choice depends on the situation. While keeping rent the same ensures resident retention, it may lead to lost revenue. Fixed percentage increases provide simplicity but may not align with market fluctuations. Market-driven adjustments keep rents competitive but can be challenging to implement if the current rate is too high or low, and the process can be time-consuming. Cost-based pricing ensures expenses are covered but can lead to inconsistent hikes. The hybrid approach provides balance but requires careful analysis.

As a property manager, you aim to find the best strategy that maintains profitability while keeping residents satisfied, ensuring a sustainable and thriving rental business. By carefully weighing market conditions, expenses, and resident retention strategies, you can make informed decisions that benefit your business and residents in the long run.